**Disclaimer: All opinions and ideas expressed in this article are solely mine and none represent a recommendation or should be viewed as advisement of any kind to anyone to do anything.**

This post is sponsored by:

Saatva Mattresses (my link gives you 15% off all purchases, a discount that stacks on any discount Saatva is running at the time!) If you are purchasing in a showroom and not online, let them know Dr. Dana Strauss sent you and you will receive the same 15% discount.

Top of Mind

The Advancing Chronic Care with Effective, Scalable Solutions (ACCESS) Model Request for Applications (RFA) is Here

The Centers for Medicare and Medicaid Innovation CMMI released the ACCESS RFA this week. It provides many more details about participation requirements but does not yet share the funding levels for the monthly Outcome Aligned Payments (OAPs) that will be billed for care provided by ACCESS organizations.

My Take

One thing I’m thinking about now as I review this RFA is how a traditional practice who wants to offer services available through the ACCESS Model mechanisms (such asynchronous care and digital health tools’ support) can participate directly rather than avoid what could easily become fragmented care between the ACCESS organization and the providers caring for those patients. This is particularly top of mind for me for two of the ACCESS Tracks for Musculoskeletal (MSK) and behavioral health.

The care provided for these conditions is typically via rehabilitation therapists and behavioral health providers, respectively. While many don’t consider these providers primary care, they are often providing the frontline primary care for MSK and behavioral health conditions, not the primary care practice.

Here’s an example of a scenario I’m thinking through:

Let’s say I’m a PT treating a patient for mechanical low back pain. PTs have direct access in every state under licensure and may evaluate and treat patients with Medicare with a physician signature on the plan of care. (Most other payers don’t require a physician referral or prescription for physical therapist care.)

Let’s say I’m seeing them twice per week and they are simultaneously participating in a robust self-management program to achieve the goals based on their rehab prognosis. I’m billing for the in-person and/or telehealth visits during this episode, and I would like to add on asynchronous communication with my patient and a digital health education support tool for additional patient engagement, which I assess will improve the likelihood of the patient achieving long term symptom resolution and help prevent a subsequent disc derangement.

I’d also like to collaborate with the patient’s PCP and share the comprehensive care plan and results of the interventions, including those achieved through the OAP-reimbursed solutions. I’ll track the outcomes and cost of both the episode and the longer-term healthcare utilization related to this condition and be integrated into the longitudinal care plan for the patient as part of the team.

If I’m billing FFS for treating the patient, I’m looking for clarification about how I can provide the ACCESS treatment simultaneously (if I’m approved to be an ACCESS org as a Med B provider) rather than choosing between traditional treatment per statute and the ACCESS treatments or referring the patient to a different organization to manage this carved-out service in my patient’s care plan.

If I would have to refer the patient to the ACCESS org for the additional services that I’ve assessed would improve the chance of meeting long term goals, the ACCESS org’s obligation is to the PCP, who may not be actively involved in medical management of the patient, not the physical therapist. Also, if I have access to the ACCESS org services and I’m the treating PT, I could strategically and efficiently deploy services in my patient’s comprehensive treatment plan. That could mean a reduced number of FFS PT visits in total and lower contribution to total cost of care.

I’ll have to give this more thought as I fully digest the RFA.

Drug Price Negotiations and Two CMMI Drug Models Announced on Friday

President Trump announced Friday afternoon that the White House secured agreements with nine additional pharmaceutical companies (bringing the total to 14) for “Most Favored Nation” pricing on Trump Rx. The companies agreed to reduce the prices on some of their drugs to the prices paid by other wealthy countries. Three other pharmaceutical companies have not yet made an agreement with the White House for the MFN pricing deals. Here are the 14 companies. The first nine are new:

Novartis

Amgen

Bristol Meyers Squibb

Boehringer Ingelheim

GSK

Merck

Sanofi

Gilead Sciences

Genentech

Pfizer

Eli Lilly

Astra Zeneca

Novo Nordisk

EMD Serono

The following three companies haven’t finalized commitments

Regeneron

Johnson and Johnson

Abbvie

Here’s an opinion piece sharing concerns about MFN if you are interested in checking it out.

Also Announced 📣

CMMI Has Released Notice of Proposed Rulemaking (NPRM) for Two Medicare Drug Models

One is for Medicare Part B drugs, the other is for Medicare Part D drugs.

This model focuses on drugs administered in a clinical setting, like chemotherapy and autoimmune medications. GLOBE is a mandatory, 5-year program aimed at reducing Medicare Part B drug costs by tying prices to what economically comparable countries pay. If finalized, it will launch on October 1, 2026.

What it does 👇

GLOBE would require manufacturers to pay rebates when their Medicare Part B drug prices exceed an international benchmark based on pricing in similar developed countries. Americans currently pay three times what other developed nations pay for the same medications.

This model focuses on drugs obtained via pharmacies. GUARD is a mandatory 5-year program aimed at reducing Medicare Part D prescription drug costs by benchmarking prices to economically comparable countries. If finalized, it will launch January 1, 2027.

What is does 👇

GUARD would require manufacturers to pay rebates when their Medicare Part D drug prices exceed an international benchmark based on pricing in similar developed nations.

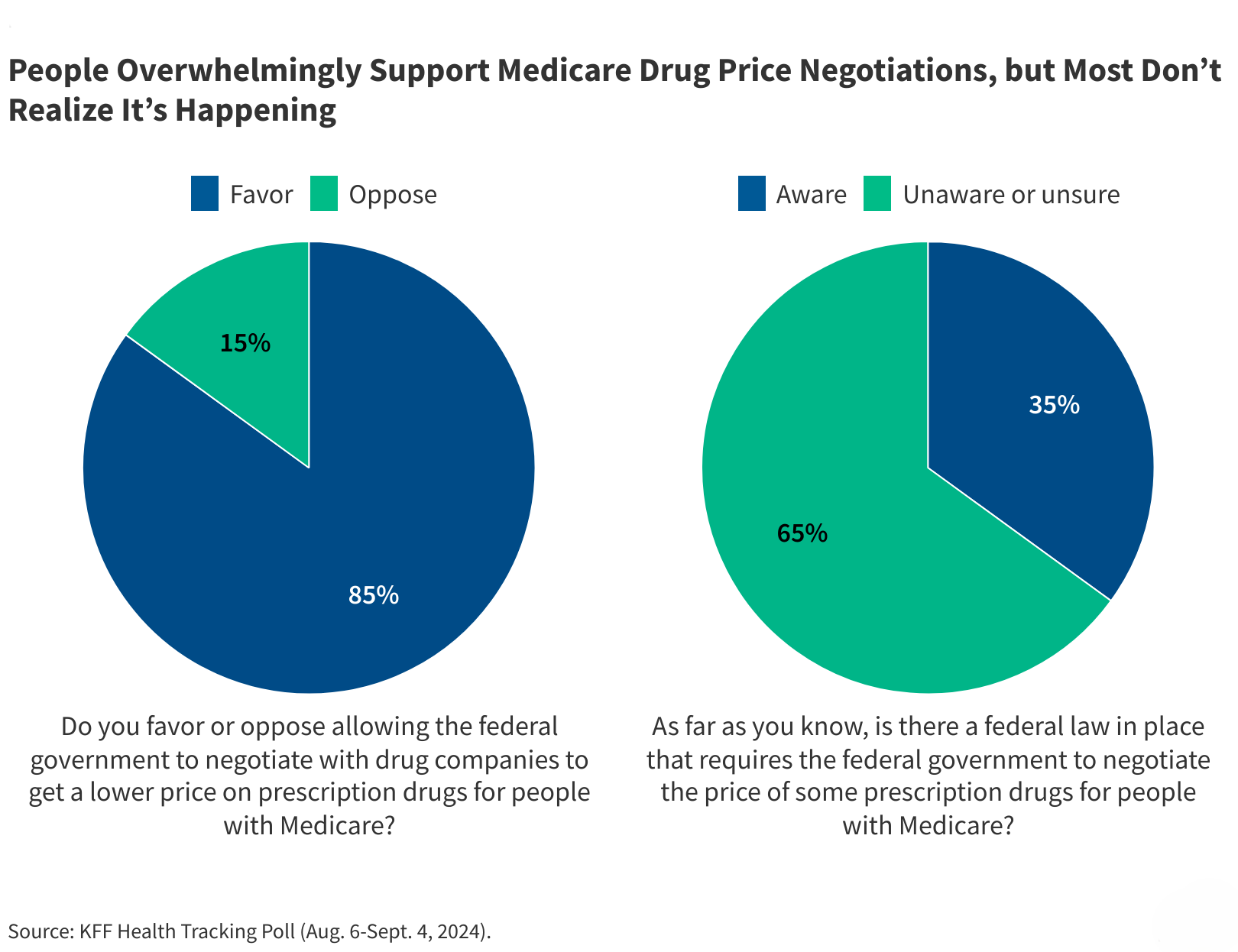

Don’t forget the Inflation Reduction Act Negotiations

The IRA, a Biden-era law passed through Budget Reconciliation when the Democrats held the Executive branch and both Houses of Congress, included the Medicare Drug Price Negotiation Program.

Here are the drugs selected for 2027 negotiation 👇

Here are the drugs previously selected for 2026 negotiation, going into effect in January 👇

For additional reading on this, here’s KFF’s FAQs:

My Take:

This is the second Administration in a row to create vehicles to address rising drug costs. Medical cost trend is influenced by a number of factors, which I’ve talked about in the past. Drug costs are both an access and affordability issue, top Healthcare challenges for Americans. Both parties are attempting to make their mark on the issue of drug prices.

The ACO REACH Successor Is Here!

The ACO REACH Model is a seven-year Innovation Center model ending December 31, 2026. It is testing prospective, capitated payments up to full financial risk in Traditional Medicare. For especially advanced primary care providers who have transformed their practices in team-based care delivery, this model enables advanced primary care, team-based practices to create the same clinical care structure for their TM beneficiaries as many have with their Medicare Advantage plan contracts.

Quick recap on ACOs—payers, providers, and patients all benefit when providers are incentives to deliver the right care (including prevention, early detection, and care management) at the right time in the right place. Improved health outcomes are the direct result of paying providers for different things. In full-risk VBC programs, providers own the responsibility of spending the payer’s budgeted dollars well. Most invest in deploying more resources at the primary care level. Providers can be very successful in these arrangements by building teams, workflows, and patient engagement structures so the use of and need for emergent care, hospitalizations, and low value and avoidable care is reduced.

It’s no small feat. But the benefit to these providers is they share in the savings from the avoided high-cost spend. And the benefit to patients? They have better access to more upstream care, wrap-around care, and a team of experts who want nothing more than for them to be healthy and home in the community.

When an Innovation Center model ends, a few things can happen. It can be successful enough to be made permanent, like the Home Health Value-Based Purchasing program and the Medicare Diabetes Prevention Program. Parts of it can be made permanent inside the traditional Medicare program, like waivers in the Medicare Shared Savings Program. Or the next generation of the model can be implemented, sometimes via a mandatory program. An example here are the Bundled Payments for Care Improvement and the Advanced version, now becoming the mandatory Transforming Episode Accountability Model (TEAM), starting January 1, 2026.

There’s been angst about the end of ACO REACH. This model was born from the very similar Direct Contracting Model and prior to that, the Next Generation ACO Model and before that, the Pioneer ACO Model. One might assume that this next model, after a ten-year test, will become a statutory component of the Medicare program after testing iterations for many years. In the below video, Abe Sutton explains this intent.

Enter the Long-Term Enhanced ACO Design (LEAD) Model 🎆

First, a caveat. The Center for Medicare and Medicaid Innovation (CMMI) has released just enough information so far to calm our panic about how these practices will participate in a full-risk model for TM patients twelve months from now. They have implied some things while others are a bit more clear. So please do your own due diligence in interpretation by clicking on the model link and reading other thought leaders in this space who are opining on this announcement. I’m sharing what I know and how I’m reading the tea leaves of partial information in the context of themes and references made publicly by CMS over the last few months.

What we Know:

LEAD is a voluntary, 10-year ACO model for TM beneficiaries. It is managed and funded by CMMI. It will launch on January 1, 2027, the day after the end of the ACO REACH model. This will be the longest ACO model to date, which is designed to foster long-term stability and innovation. This is different from ACO REACH, which was a shorter-term model. In LEAD, there are fixed benchmarks for the full 10 years of the model, which removes the rebasing issues from benchmark resets.

Like ACO REACH, LEAD offers two tracks:

Global Risk—100% of savings or losses

Professional Risk—50% of savings or losses

LEAD also provides enhanced and flexible upfront payments, including capitated, population-based cash flow support to ease administrative burden and sustain proactive care.

LEAD will also expands eligibility to smaller, rural, and independent practices, including FQHCs, RHCs, and Medicare FFS providers not previously in ACOs. It also intensifies focus on homebound and dually eligible Medicare-Medicaid patients, offering strategies and tools for better coordination of care.

LEAD Incorporates the Complex, Homebound, and Home Limited Population

ACO REACH has a specific, separate track for “High Needs” beneficiaries. Those ACO participants have provided in-home advanced primary care to some of the most complex, often seriously ill beneficiaries with significant mobility impairments. By embedding these beneficiaries into LEAD rather than forcing providers to choose between only managing this population and the standard Medicare population, providers can include their full patient panel while (apparently) benefitting from the more generous benchmarking structure of the ACO REACH High Needs Track. We need more information on this, but it is implied here 👇

Specialty Care Integration

LEAD includes the new CMS-administered risk arrangements (CARA) to enable episode-based contracting with specialists and downstream providers. While ACO REACH offered ACOs the option of creating formal alternative payment agreements with specialists via the “Preferred Provider” mechanism, adoption was poor. The feedback CMMI received from participants was that they didn’t have the expertise to administer these on their own without a more structured framework. This makes sense. When a practice enters into risk arrangements with Medicare Advantage plans, the plans collaborate with the providers and bring needed expertise to developing those arrangements. In CARA, CMS will do the heavy-lifting, incentivizing providers with the tools and resources to successfully implement arrangements with high-value providers.

Falls Prevention! 👏🙌 🥳

I couldn’t be more excited to read this, and I hope my fellow physical rehabilitation providers are equally as excited and motivated to participate! From what CMS shares on the landing page and Abe Sutton and Gary Bacher of CMMI share in the below video from an interview with AMA President Dr. John Whyte, among the first CARA efforts is the launch of a falls prevention program featuring evidence-based intervention services curated for use by ACOs.

It will allow ACOs to quickly connect patients to proven falls-prevention services such as balance assessments, home safety evaluations, and exercise without having to build these programs from scratch themselves. It allows ACOs and their providers to leverage a CMS-endorsed prevention pathway integrated into care delivery under an advanced value-based model.

Additional Incentives and Support

LEAD will offer an add-on payment for rural providers to support infrastructure investments, which is a big shift! They also introduce new beneficiary enhancements and engagement incentives including the option of a cost-sharing buy-down for Part D premiums by 2029, which is a first.

Here are Abe Sutton and Gary Bacher discussing LEAD with Dr. John Whyte of the AMA. 👇

More information will be available in early 2026 with applications opening this spring.

My Take

Unlike ACO REACH, which had participants from both health systems and provider practices, this model is more deliberately aimed at advanced primary care practices and similar organizations. I suspect when we see the benchmarking structure, it will be more favorable for those participants. By including the complex patients whose risk was not fully captured (medical, social, functional, etc) in ACO REACH unless your ACO’s sole focus was the complex, homebound, or home-limited population, funding levels for ACOs to care for those beneficiaries should be particularly favorable. In other words, if your ACO has a significant percentage of complex beneficiaries, you may have higher funding levels for those beneficiaries on a PMPM basis than you did in the Standard Track of ACO REACH.

I also think we will see more advanced primary care providers exit MSSP and apply for LEAD instead. I’ll be better able to predict this once CMMI shares details about the benchmarking and financial structures of the model.

And as a doctor of physical therapy who spent many years addressing the impacts of non-medical (functional and social) drivers of health in the home that led to loss of mobility and independence and frequent medical care events, I’m thrilled to see a falls prevention program noted and look forward to reading more. 😁

Resources, Research, and Reading

What is Fast Healthcare Interoperability Resources (FHIR)?

You may hear this acronym throw around, and it’s important to know what it means. Pronounced “fire,” FHIR is a standard for exchanging healthcare information electronically developed by the Health Level Seven International (HL7). It’s purpose is the enable different healthcare systems and organizations like EHRs, apps, hospitals, payers, etc. to share data in a way that’s secure, consistent, and interoperable.

It uses web technologies like RESTful APIs and JSON to make it easier for developers to integrate healthcare data into applications. The core concept to understand in FHIR is the “resource,” which represents a piece of healthcare data such as patient, medication, appointment, etc.

Since CMS and the CMS Innovation Center are deeply committed to advancing interoperability, it’s important to understand the basic concepts of FHIR and what they mean for you.

Here’s a resource from a Substack I found that I had saved to my “second brain” months ago that breaks the concepts down nicely:

Low Value Care in Medicare

I don’t know providers who like dealing with prior authorization and denials. But if you understand denial patterns, you can anticipate the direction of regulatory changes. Denials can be seen as a signal in the shift towards value-based care, where the potential outcomes are considered when determining whether something should be covered. They do create internal administrative inefficiencies in practices, but they serve as a way to curb low-value care by discouraging unnecessary and/or duplicative services.

In this December 16, 2025 Health Affairs article, Michael Chernew and A. Mark Fendrick discuss clinical “grey areas” where evidence is limited or outcomes are uncertain.

They talk about how they are unavoidable and must be acknowledged, and that Medicare must address them. Depending on the program, Medicare uses strategies like utilization management, including the Wasteful and Inappropriate Spending Reduction (WISeR) Model and prior authorization, and value-based care incentives (like the Medicare Shared Savings Program) to prevent spending on low value care.

Bedbound in the Final Year of Life | Dementia Drives Caregiver Strain and Highlights Policy Gaps

Insights gleaned from this JAMA Open Network article published online December 19, 2025 entitled “Bedbound Status During the Last Year of Life Among Community-Dwelling Older Adults,” by Katherine A. Ornstein, PhD, MPH, Mary Louise Pomeroy, PhD, MPH, and Hanna Charankevich, PhD.

Highlights and Takeaways

One out of every six older adults spend at least one month bedbound before death. For those with dementia it’s 77%.

This is a cross-sectional analysis of community-dwelling decedents using data from the National Health and Aging Trends Study to estimate bedbound prevalence and associated characteristics during the last year of life. The authors classified bedbound status by frequency of leaving the bed/bedroom, requiring assistance, and having difficulty transferring. They also examined dementia status, frailty, sociodemographics, and the care they received.

In their study, they found 16.6% of decedents were bedbound in the year before death, or about 2.5 million people, and those with dementia had a fivefold higher odds of being bedbound. With bed boundedness comes inevitably higher need for caregiving hours and they did receive almost three times as many hours. They were also more likely to require paid care.

The study surfaces what we who have worked in the home-based site of care know well. There are not enough supports for caregivers and not enough home-based care resources available for those who cannot live without support for activities of daily living and instrumental activities of daily living.

The price of private pay caregivers is out of reach for many Americans and their families, adding to the burden on friends and family if they are even available. Proactive clinical planning should be initiated well in advance of significant functional decline. For those with dementia, who may not regularly be able to visit their provider regularly because of social and functional limitations, it’s critical to have access to a home-based primary care provider and their team who can help with this process. Here’s an example of the type of provider I’m talking about.

Expanded home and community-based services are needed to make a dent in the needs of the homebound and then often bedbound population of seriously ill and those with complex care needs. Policy will need to enable much of this at both the state and federal level.

*Disclaimer: All opinions and ideas expressed in this article are solely mine and none represent a recommendation or should be viewed as advisement of any kind to anyone to do anything.*